While having your NDIS plan signed, sealed and delivered should be a huge relief, the prospect of juggling a budget can feel daunting. Never fear, with a few key insights, you can make sure your supports aligns with your needs.

Fundamentally, planning your budget starts with having a very clear picture of your goals, and how you feel they can be achieved. That has to be the starting point for everything. Because if you’re not 100% clear on where you’re going, how can you get there? And how can you choose the right people and organisations to make it happen?

Where you can spend your NDIS budget

Your needs and goals will have been articulated in your NDIS plan, so use that information to help you visualise your end game, and break down your budget accordingly. As part of that picture, your plan will allocate funding across three areas:

- Core Supports

- Capacity Building Supports

- Capital Supports

Before you do anything else, you’ll need to understand what supports are linked to each of these category budgets. Everything from in-home support to assistive technology and allied health services.

Cost of disability supports

Getting to grips with what those services and products actually cost, and where you can source them, is really important. While the NDIA sets price limits for some of the supports included in your plan – the recommended price a registered provider can charge you – providers decide their own prices within that parameter.

As part of that process, it’s important you’re clear on when potential providers can begin delivering services. Waitlists and delays don’t just mean missed supports, they also mean that you might get less time in a 12 month plan to access all of your supports, leaving unspent funds (more on that below), and hence need factored into your budget calculations.

Crunching the numbers

When you sit down with your budget, and an understanding of needs and costs, you can start to divide everything out against your goals. Your budget for daily, weekly and monthly supports can be calculated by dividing the available funds by 365, 52 or 12, and then subtracting any expected holidays or breaks in supports.

Also think about periods where you may need additional assistance, such as when any informal supports aren’t available, seasonal variations, or planned procedures or activities that will cause your needs to change.

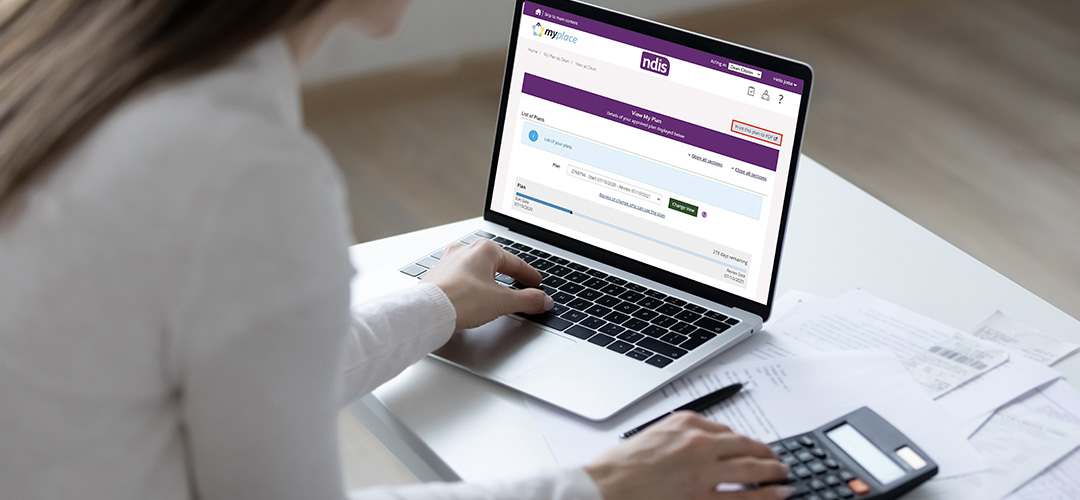

Monitoring your NDIS spending and progress

It’s important to keep an eye on your budget throughout the year – the My NDIS app is a tool for tracking your spend. It can also be useful to schedule regular reviews with your support coordinator or Local Area Coordinator. As part of that process, you can continually collate evidence around how those supports have helped you move towards your goals – information that will be useful for your next NDIS Plan.

Staying budget-focused is essential to prevent any gaps in support. If you’re concerned that your funding may run out, call the NDIS Contact Centre. That said, underspending can also be problematic – you may have to fight hard to justify why, having not used certain allocations.

For more information on how Care Squared can support you in reaching your NDIS goals:

- complete the Care Squared referral form, or

- call 1300 632 639